AML & Internal Tooling

Lopay has a number of internal tools to actively monitor and restrict accounts which have passed the onboarding process. Such software is updated regularly to maximise effectiveness by iterating on learnings from historical account behavior.

Below is a suite of evidence demonstrating the internal tooling used by Lopay. This is in addition to the tools offered by Stripe.

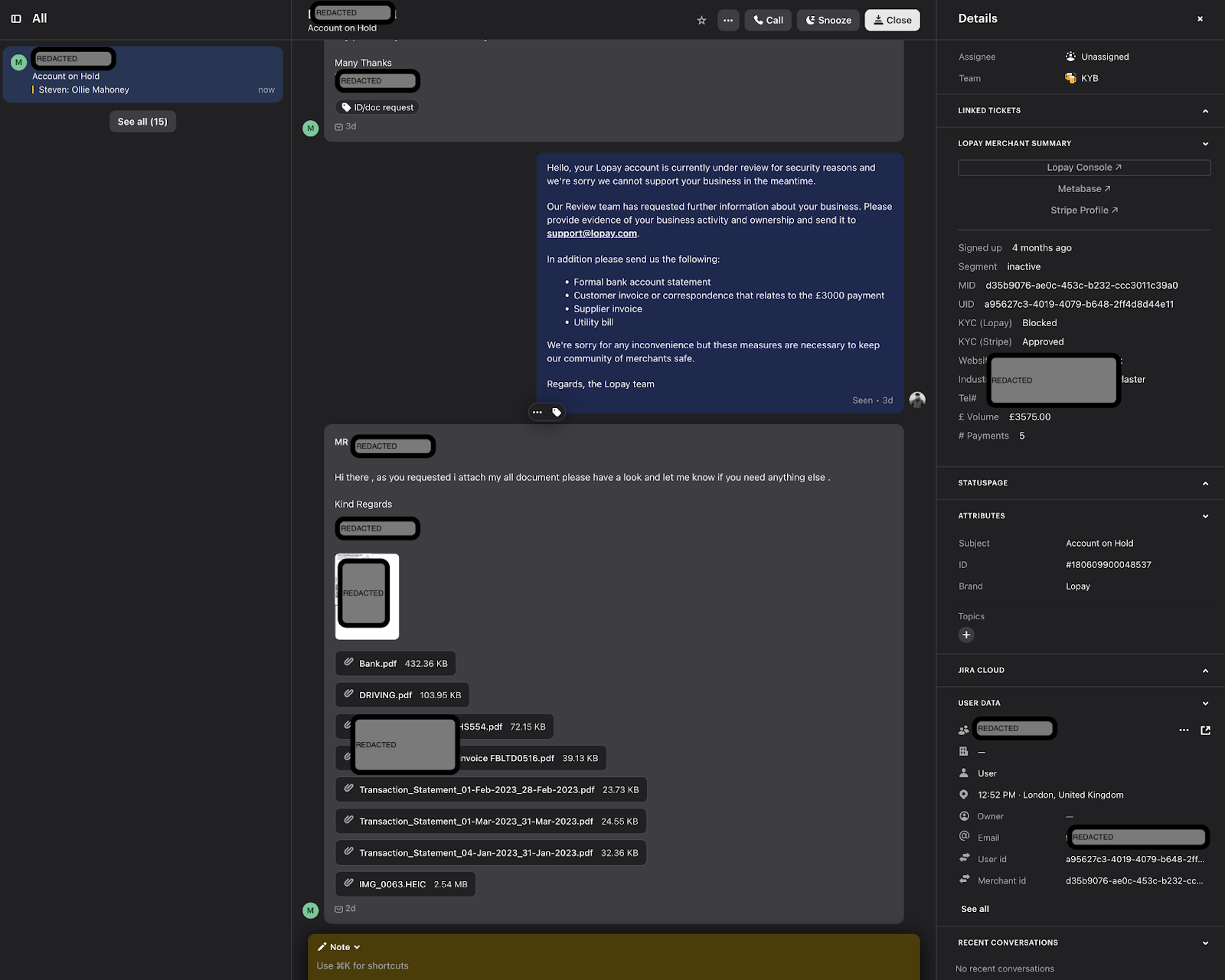

Evidenced Example 1 - Actively monitoring for alerts

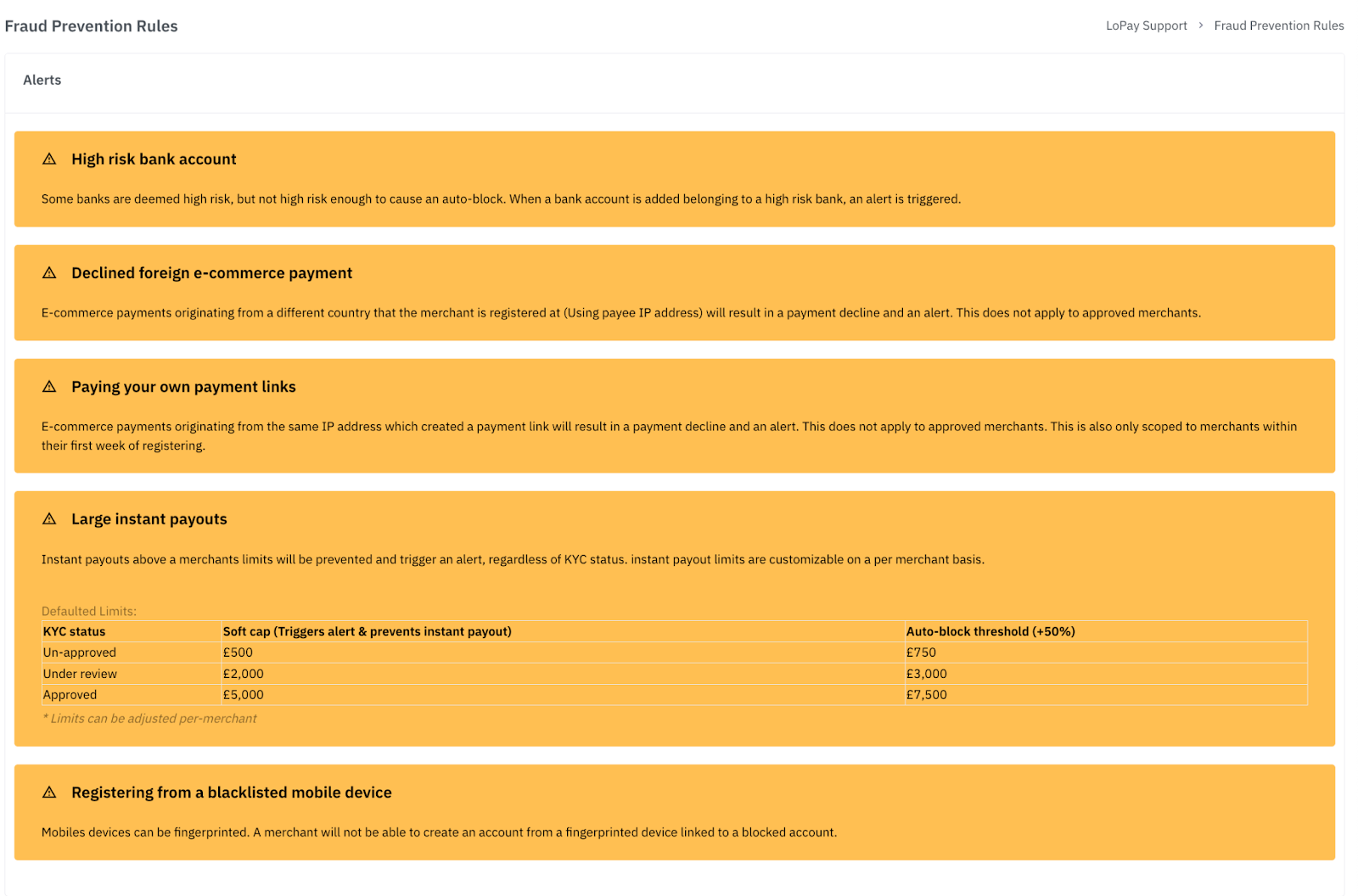

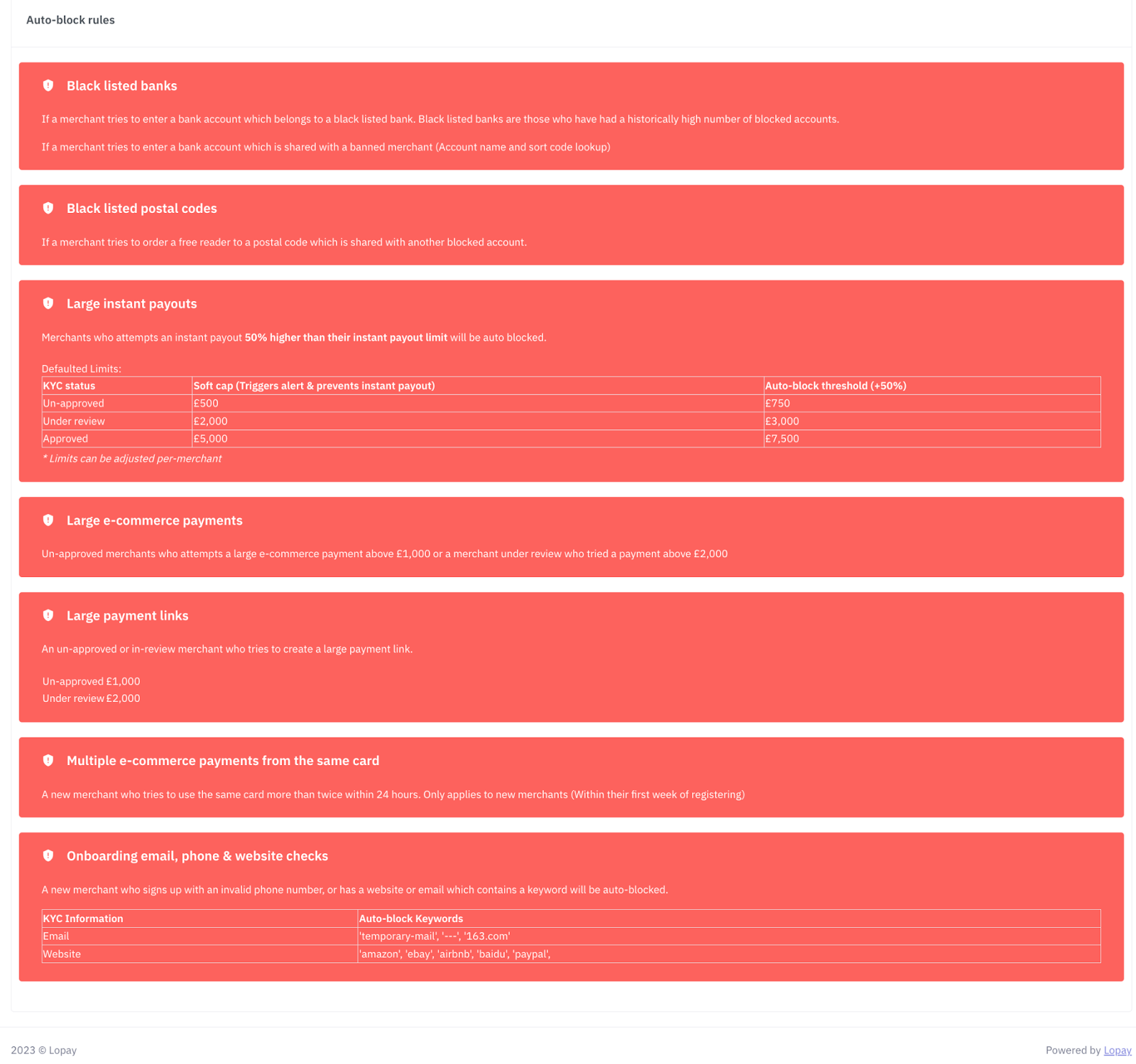

Evidenced Example 2 - Actively flagging and blocking accounts

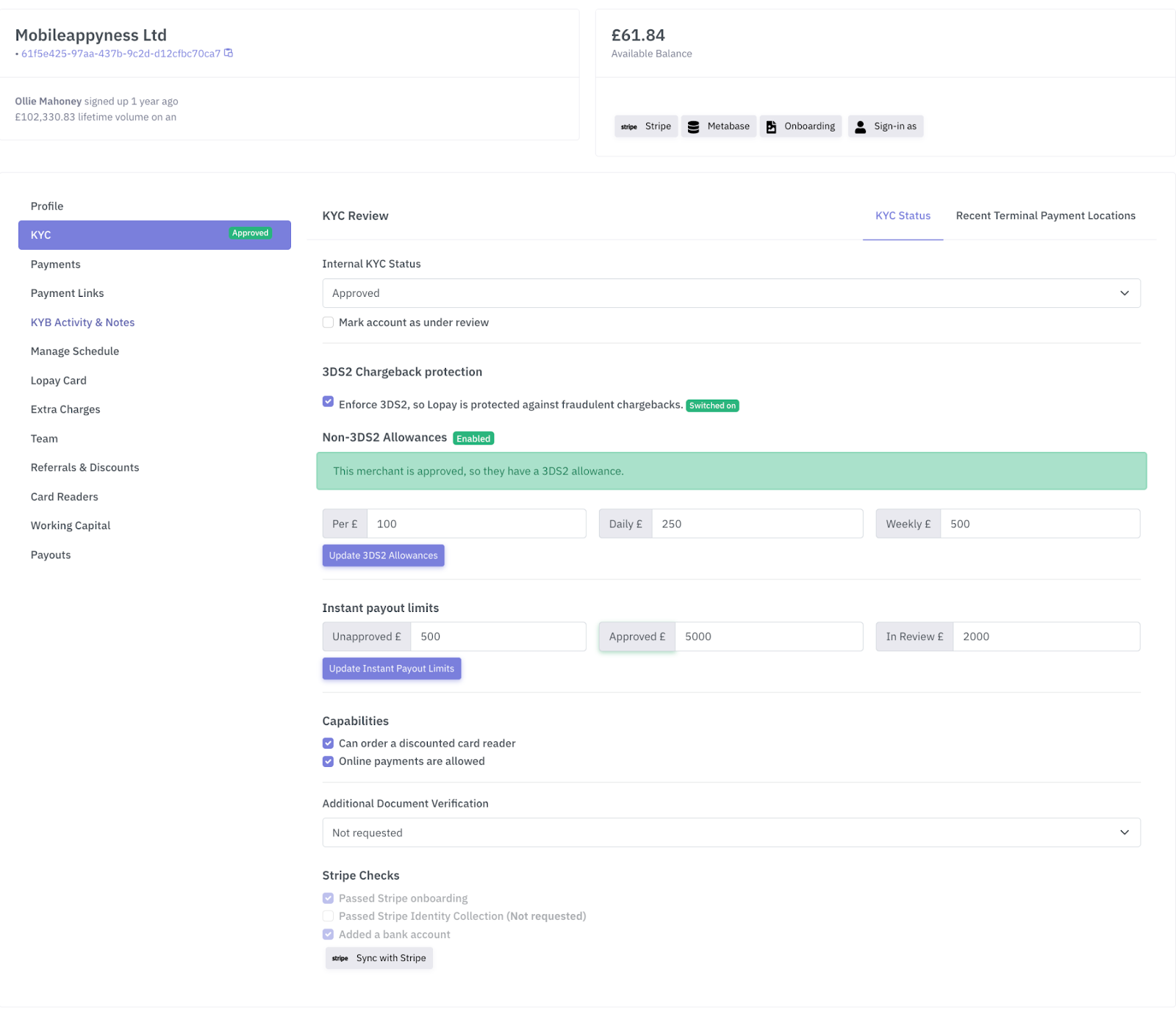

Evidenced Examples 3/4/5 - Internal tooling to control & restrict accounts

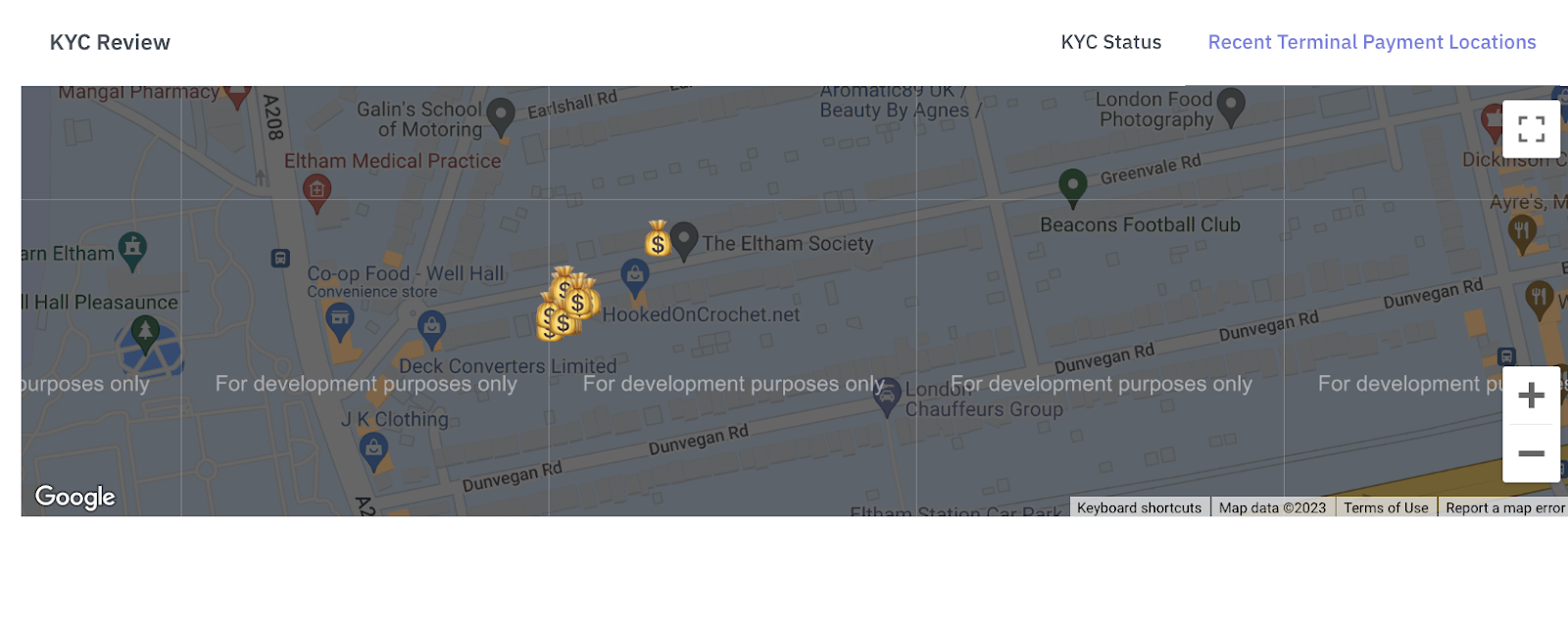

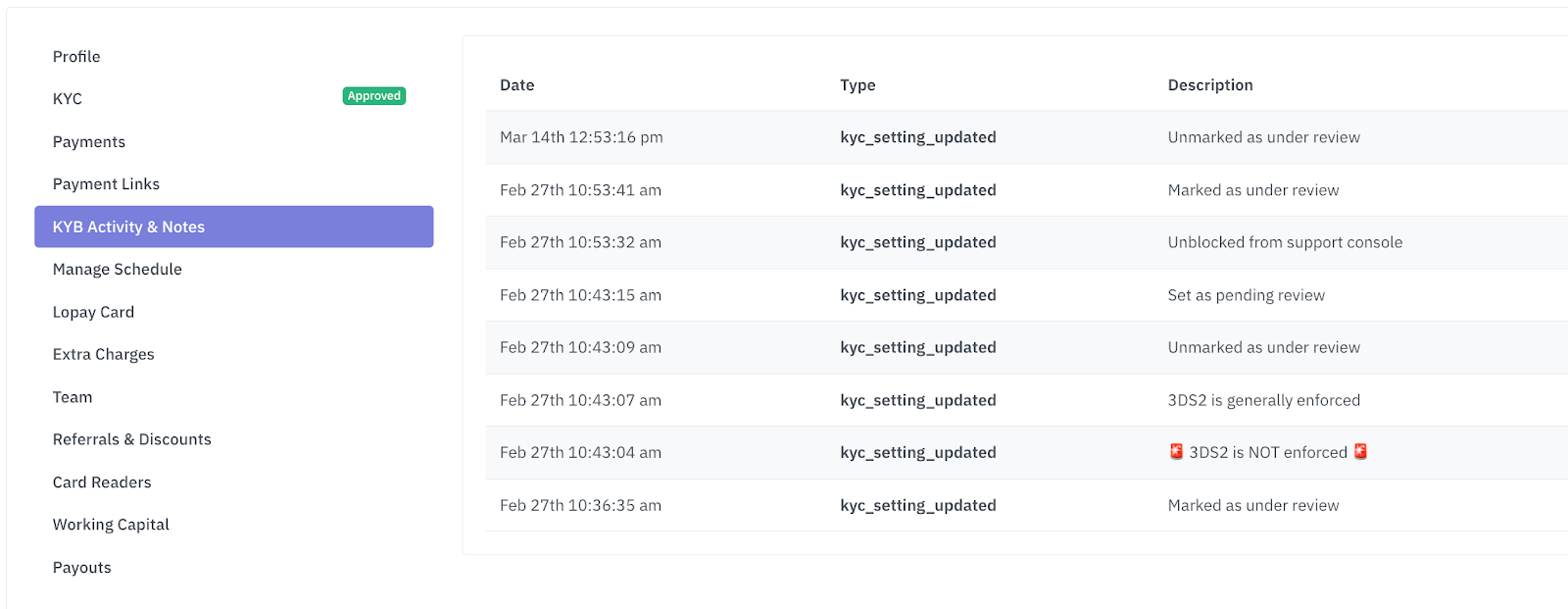

Screengrabs from Lopays internal tooling. Permission was granted from the account holder to share the information contained within this screengrab.

Above - demonstration of internal tooling to control and restrict Lopay accounts.

Above - demonstration of internal tooling to asses the geographical location of payments when assessing risk.

Above - demonstration of internal tooling to track account alerts or updates made by customers or by the Lopay team.

Evidenced Example 6 - Internal tooling to assess additional documents